*This is the 30th day of the One Month Spending Freeze Challenge. Please click here to see all of the posts in this series.*

In a few days, you will no longer be doing this spending freeze, unless you choose to continue. That means you could easily fall back into your old ways or you could be changed from this experience.

What’s Your Time Worth?

What’s Your Time Worth?

I don’t know if you realize this, but your time is valuable. You and/or your spouse spend 40 hours a week at work, so you should be finding out what each work day is buying you.

I want you to know for yourself what your own take-home pay is getting you in life. To find out, we’re going to do a little exercise that will help you see if the money you are spending is worth your time or not.

1. Get out a calendar

Get out a blank calender and open it up to November (or the next month if you are doing this challenge some other time). You can also download a calendar for free and edit it in Word.

2. Take note of all your expenses

Now, look at your budget and all your expenses and their amounts. Order your expenses from highest amount to lowest amount (or most important to least important if that makes more sense to you).

3. Find out your take-home pay

Calculate how much money you make on a daily basis. If you bring home $2,000 every two weeks (use your net income amount, so leave out taxes), then you make $200 each day ($2,000/10 days). If you are paid hourly, you can also just put down the after-tax amount that you are paid per hour.

4. Plot your expenses on the calendar based on your take-home pay

Start plotting your expenses on the calendar according to how long it takes you to earn the money to pay for that expense.

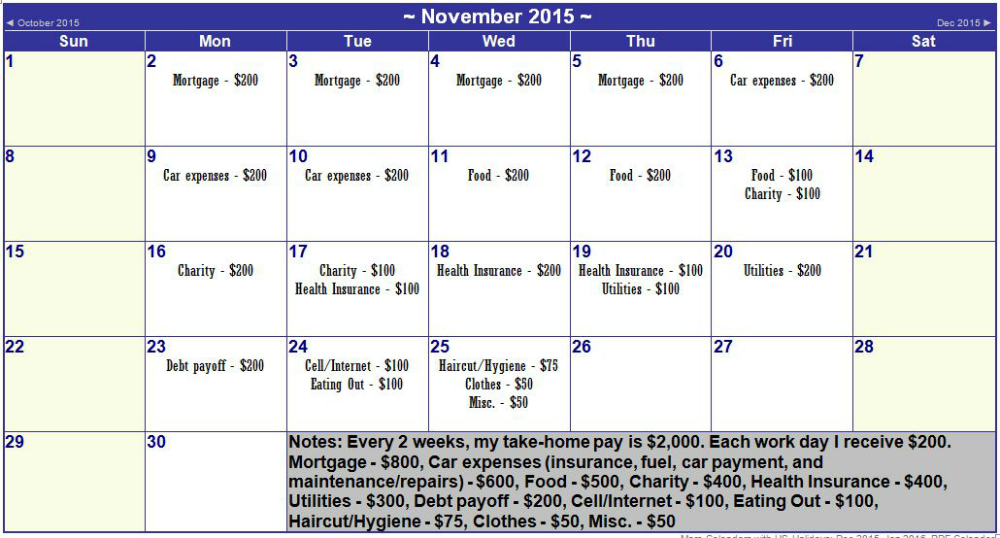

Here, I’ll show you a hypothetical example. It’s very simple and likely leaves out a lot of expenses that most people might have, but it’s just to help you see how to do it.

I’ll walk you through this example so you can see what I did and the outcome:

- This person is paid every 2 weeks. They receive $2,000 after taxes, so their take-home pay for each work day is $200.

- I only plotted expenses on work days. This person works Monday through Friday, and they can look at this each day and say, “Today I’ll be working for…” to either keep them motivated or to keep them from spending on something else.

- The biggest expense for this person is $800 for their home. The first four work days are spent working to pay for the mortgage.

- Next, the car expenses cost about $600 each month and cover the next three work days.

- The rest of the expenses that this person has are food ($500), charity ($400), health insurance ($400), utilities ($300), debt payoff ($200), cell phone/internet ($100), eating out ($100), haircut/hygiene ($75), clothes ($50), and miscellaneous spending ($50).

- After plotting all the expenses on the calendar based on $200 earned each work day, this person still has 3 full days of money left as well as $25 on the fourth to the last work day. Essentially, they have $625 left in their month.

- This person was not saving money before, because they thought they could not. But they can see that they are left with $625, so they move that expense right after the mortgage and replot.

It can be time-consuming to plot your own spending based on how much money you make, but it will be so worth it when you can visually see how long it is taking you to work for something.

If your eating out category were $500, for example, would you really want to spend 2 1/2 working days to pay for that? I doubt it.

This calendar can give you motivation if you use it each month to stick to your budget. It can also just deter you from spending so much money in an area that you know you spend too much.

Have you ever used a calendar to easily see how much you spend in certain budget categories?

This is great advice Charlee. I actually use this exact method but it’s through my bank, online. They calculate my paychecks, bills, etc. for me so I can see what’s coming and going. For anyone who doesn’t have that option, I would seriously endorse doing exactly what you’ve laid out here. Having a calendar (especially for visual learners) is a game-changer. You can physically see where your money is going and when. One tip I’d add is using a whiteboard at home to write down any major things. We use our whiteboard to write down all of our debts and savings balances – it keeps it in our face so we want to take more action on it faster.

How interesting, Chris, I had no idea some banks could do this for you. I love the idea to use a whiteboard, and I think my husband would benefit the most from that. He would understand our financial picture so much better by glancing at it, rather than hearing numbers. Thanks for the idea!